- #Purchase order and invoice difference manual

- #Purchase order and invoice difference software

- #Purchase order and invoice difference code

- #Purchase order and invoice difference download

#Purchase order and invoice difference software

Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner.

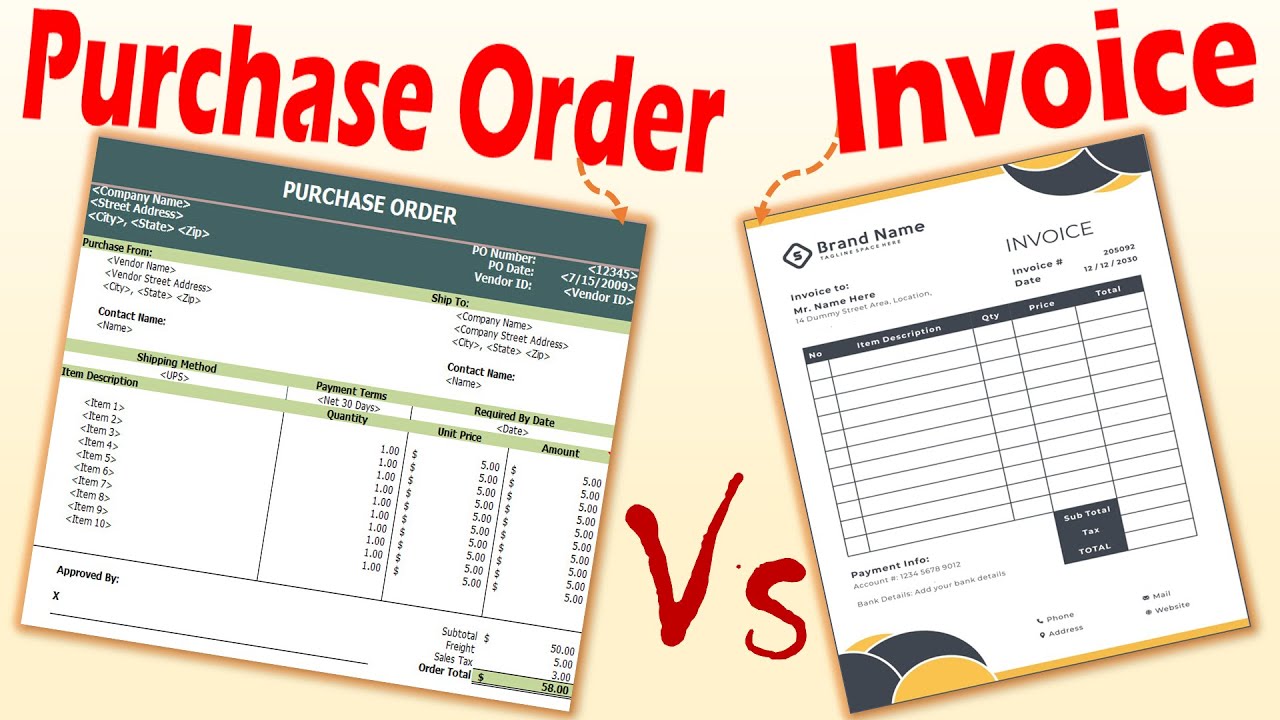

Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.ĬAs, experts and businesses can get GST ready with Clear GST software & certification course. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Just upload your form 16, claim your deductions and get your acknowledgment number online. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.Įfiling Income Tax Returns(ITR) is made easy with Clear platform. The vendor sends an invoice to the purchaser to request payment for the order placed.Ĭlear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. The purchaser sends a purchase order to the vendor to place an order for goods/services. It contains details of products sold, quantity and rate as approved in the purchase order, tax, approved purchase order number, etc. It contains client expectations such as the nature of product, quantity and price, and other terms of procurement. It helps in generating various financial reports and projecting future cash flows.Ĭomparison between purchase order and invoicing.Like POs, invoices also form part of the audit trail.It serves as a legal document and helps in financial reporting.It is sent to the buyer requesting payment for goods sold. Invoices enable the vendors to collect money.It reflects the type of goods sold and the amount due from the buyer, and the due date of payment. It gives legal protection.Īn invoice is created by the vendor for goods sold. A PO, once accepted by the vendor, becomes a legally binding document.Once a PO is created, a purchaser can look into its budget and spend wisely.POs specify the purchaser’s needs and thus set clear expectations for the vendor.Once the vendor accepts a PO, it becomes a legally binding document that specifies the type of goods, price, delivery date and payment terms.

#Purchase order and invoice difference manual

Your accounting team doesn’t have to use multiple systems, remember due dates, or do manual data entry throughout the day.A purchase order (PO) is a document the buyer uses to place an order mentioning the goods required, delivery date, price and other terms and conditions. Volopay makes your invoice payments simplified and streamlined. Seamless accounting integration is possible in Volopay hence your employees don’t have to move every expense manually into other applications. After the payment, you can sync the expense with your other accounting software within Volopay itself.ġ5.

#Purchase order and invoice difference download

Now you can download the vendor receipt by clicking on the bill.ġ4. As soon as the vendor payment is made, you will be notified through push notification.ġ3. You can see the status of the bill anytime on Volopay.ġ2. If the approvals are successful, the invoice payment will be released on the scheduled date and time.ġ1. If the approver rejects the invoice, then vendor payment will be stopped.ġ0.

After approvals, it awaits in the payment queue till the due date.ĩ. Once the bill is created, it goes to the approver’s inbox.Ĩ. If it’s a new vendor, create the vendor first and bill later.ħ. If the vendor already exists in the system, a bill is generated with the amount you are liable to pay.Ħ.

#Purchase order and invoice difference code

Your AP team enters the invoice details into the Bill Pay system by selecting the vendor, billing amount, and other payment-specific details like department code and team.ĥ.

If there is any discrepancy, the invoice payment will be stalled, and the vendor will be notified.Ĥ. They verify the invoice with the PO request and try to detect if the purchase order details match.ģ. Your AP team will receive the invoice and verifies if the data is correct through the purchasing department.Ģ. Here is what happens when your vendor releases an invoice:ġ. When you use an expense management system like Volopay, your whole invoice processing becomes automated and mess-free.

0 kommentar(er)

0 kommentar(er)